Delve into the world of auto insurance with a comprehensive look at Costco Auto Insurance versus traditional providers. Explore the key differences, features, and nuances that set them apart in this intricate comparison.

Uncover the various coverage options, pricing structures, customer service experiences, and more as we navigate through the realm of auto insurance providers.

Overview of Costco Auto Insurance and Traditional Providers

Costco Auto Insurance offers competitive rates and benefits to Costco members, including discounts and perks. Their policies are underwritten by leading insurance companies, providing quality coverage for drivers. On the other hand, traditional insurance providers like State Farm, Allstate, and Geico have been long-standing players in the insurance market, offering a wide range of coverage options to customers.

Key Features of Costco Auto Insurance

- Exclusive discounts for Costco members

- Quality coverage underwritten by reputable insurance companies

- Additional perks and benefits for policyholders

Overview of Traditional Insurance Providers

- State Farm, Allstate, and Geico are well-established insurance companies

- Offer a variety of coverage options tailored to individual needs

- Known for their customer service and claims handling

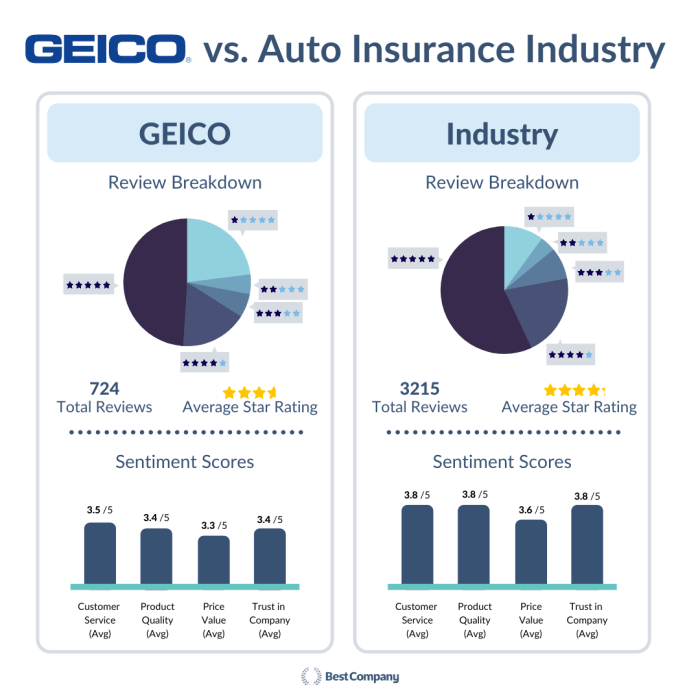

Reputation and Customer Satisfaction Levels

Costco Auto Insurance has gained a positive reputation among members for its competitive pricing and quality coverage. Traditional providers also have a strong reputation in the market, with State Farm and Geico often praised for their customer service. Customer satisfaction levels vary, with some customers preferring the personalized service of traditional providers while others appreciate the cost savings offered by Costco Auto Insurance.

Coverage Options Offered

When it comes to choosing auto insurance, coverage options play a crucial role in determining the level of protection you receive in case of accidents or emergencies. Let's explore the different coverage options offered by Costco Auto Insurance and traditional providers to understand their differences.

Costco Auto Insurance

Costco Auto Insurance provides a range of coverage options to meet the needs of its members. Some of the key coverage options offered by Costco Auto Insurance include:

- Liability Coverage: Protects you financially if you are responsible for injuring someone else or damaging their property in an accident.

- Collision Coverage: Helps cover the cost of repairs to your vehicle in case of a collision with another vehicle or object.

- Comprehensive Coverage: Provides protection for damages to your vehicle caused by incidents other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Offers coverage if you are involved in an accident with a driver who has insufficient or no insurance.

- Rental Reimbursement Coverage: Helps cover the cost of renting a vehicle while your car is being repaired due to a covered loss.

Traditional Providers

Traditional insurance providers also offer a similar set of coverage options, including:

- Liability Coverage

- Collision Coverage

- Comprehensive Coverage

- Uninsured/Underinsured Motorist Coverage

- Medical Payments Coverage: Helps pay for medical expenses resulting from a covered accident, regardless of fault.

- Personal Injury Protection (PIP): Provides coverage for medical expenses, lost wages, and other expenses resulting from a covered accident.

Comparison

While Costco Auto Insurance and traditional providers offer similar standard coverage options, Costco stands out with its unique benefits like:

- Discounts for Costco members

- Quality customer service through its partnership with leading insurance companies

- Convenience of managing policies online or through Costco warehouses

By comparing the coverage options offered by Costco Auto Insurance with traditional providers, you can make an informed decision based on your specific needs and preferences.

Pricing and Discounts

Costco Auto Insurance, like many other insurance providers, determines pricing for its policies based on various factors such as the insured individual's driving record, age, location, type of vehicle, and coverage options selected. The company uses actuarial data and statistical models to assess the risk associated with insuring a specific individual or vehicle, which ultimately influences the premium amount.

Costco Auto Insurance Discounts

- Membership Discounts: Costco members may be eligible for exclusive discounts on auto insurance policies.

- Safe Driver Discount: Drivers with a clean driving record may qualify for a discount.

- Multi-Vehicle Discount: Insuring multiple vehicles under the same policy could lead to savings.

- Bundling Discount: Combining auto insurance with other types of insurance, such as homeowners or renters insurance, may result in a discount.

Comparison with Traditional Providers

- Costco Auto Insurance often offers competitive pricing compared to traditional providers due to its ability to leverage its large membership base and buying power.

- Traditional providers may have a wider range of discounts available, but Costco's membership discounts can be significant for eligible members.

- Costco's straightforward pricing structure and focus on value for its members set it apart from many traditional providers that may have more complex pricing models.

Customer Service and Claims Process

When it comes to customer service and the claims process, it's essential to consider how efficiently an insurance provider handles inquiries and claims. Let's take a closer look at the experiences with Costco Auto Insurance compared to traditional providers.

Customer Service Experience with Costco Auto Insurance

Costco Auto Insurance is known for its excellent customer service. Members often praise the company for its responsive and helpful representatives who are knowledgeable about the products and policies. Customers appreciate the ease of reaching out to Costco for assistance with any questions or concerns regarding their auto insurance.

Claims Process with Costco Auto Insurance

The claims process with Costco Auto Insurance is streamlined and user-friendly. Policyholders can easily file a claim online or over the phone, and the claims representatives are prompt in handling the process. Costco aims to make the claims process as hassle-free as possible for its members, ensuring a quick resolution to any issues that may arise.

Comparison with Traditional Providers

When comparing the customer service quality and claims process efficiency of Costco Auto Insurance with traditional providers, Costco stands out for its personalized approach and dedication to customer satisfaction. Traditional providers may have a larger customer base, which can sometimes lead to longer wait times and less individualized attention.

Costco's commitment to excellent customer service sets it apart from many traditional insurance companies, making it a top choice for members looking for a reliable and efficient auto insurance provider.

Summary

As we conclude our exploration into Costco Auto Insurance versus Traditional Providers, it becomes evident that each option brings its unique strengths and advantages to the table. Whether you choose Costco or a traditional provider, understanding the nuances can help you make an informed decision that suits your insurance needs.

FAQ Guide

What sets Costco Auto Insurance apart from traditional providers?

Costco Auto Insurance offers unique benefits such as discounted rates for members and exceptional customer service.

How does the pricing structure of Costco Auto Insurance differ from traditional providers?

Costco Auto Insurance bases its pricing on membership benefits and bulk discounts, which can lead to cost savings for policyholders.

What coverage options are exclusive to Costco Auto Insurance?

Costco Auto Insurance provides specialized coverage options tailored to its members, such as roadside assistance and rental car reimbursement.