Starting off with How to File a Claim with Costco Car Insurance Hassle-Free, this opening paragraph aims to grab the readers' attention and provide an intriguing overview of the topic.

The following paragraph will delve into the details and specifics of the claim filing process with Costco car insurance.

Understand the Claim Process

When it comes to filing a claim with Costco car insurance, it's essential to understand the process to ensure a hassle-free experience. By following the necessary steps and having the required documents ready, you can expedite the claim process and get the assistance you need promptly.

Steps Involved in Filing a Claim

- Contact Costco Car Insurance: Notify your insurance provider as soon as possible after an accident or incident to initiate the claim process.

- Provide Details: Be prepared to provide essential information such as the date, time, and location of the incident, as well as details of the parties involved.

- Submit Documentation: You may need to provide documents like the police report, photos of the damage, and any witness statements to support your claim.

- Assessment: An adjuster will assess the damage to your vehicle and determine the coverage provided by your policy.

- Resolution: Once the claim is approved, Costco car insurance will work towards resolving the claim and getting your vehicle repaired or replaced.

Documents Required for Filing a Claim

- Policy Details: Have your insurance policy number and details readily available when contacting Costco car insurance.

- Accident Information: Provide any relevant information about the accident, including the other party's details and the nature of the incident.

- Photos and Documentation: Gather photos of the damage, the police report, and any other supporting documents to strengthen your claim.

- Witness Statements: If there were witnesses to the incident, their statements can help validate your claim.

Importance of Understanding Your Coverage

- Prevents Surprises: Knowing what your policy covers can prevent surprises during the claim process, ensuring you are aware of any limitations or exclusions.

- Maximizes Benefits: Understanding your coverage allows you to maximize the benefits provided by your policy and make informed decisions when filing a claim.

- Smooth Process: With a clear understanding of your coverage, you can navigate the claim process smoothly and efficiently, reducing delays and complications.

Contacting Costco Car Insurance

When it comes to reaching out to Costco car insurance customer service, there are a few convenient options available to you. Whether you prefer speaking with a representative over the phone, sending an email, or using their online portal, Costco makes it easy for you to file a claim hassle-free.

Preferred Methods of Communication

- Phone: One of the quickest ways to get in touch with Costco car insurance is by calling their customer service hotline. Be prepared to provide your policy details and information about your claim when speaking to a representative.

- Email: If you prefer written communication, you can also reach out to Costco car insurance via email. Make sure to include your policy number and a detailed description of your claim in your message.

- Online Portal: Costco offers an online portal where you can submit and track your claim. This option allows for easy access to your claim status and updates at your convenience.

Information Needed

- Policy Details: Have your policy number, coverage details, and any relevant documentation on hand when contacting Costco car insurance. This information will help expedite the claims process.

- Claim Information: Be ready to provide specific details about the incident leading to your claim, including the date, time, location, and parties involved. The more information you can provide, the smoother the claims process will be.

- Contact Information: Ensure that you have your contact details up to date, including phone number, email address, and mailing address, so that Costco can easily reach out to you regarding your claim.

Providing Claim Details

When filing a claim with Costco Car Insurance, it is crucial to provide accurate and detailed information to ensure a smooth process. Here are the necessary details you should prepare when filing a claim:

Accident Details

- Provide a detailed description of how the accident occurred, including the date, time, and location.

- Note the damages to your vehicle and any other vehicles involved.

- Include information about any injuries sustained by you or others in the accident.

Policy Information

- Have your policy number and insurance details readily available.

- Include any relevant documents such as the police report, witness statements, and photos of the accident scene.

- Provide any additional information requested by Costco Car Insurance to process your claim efficiently.

Importance of Accuracy and Honesty

- Accuracy and honesty are essential when providing claim details to avoid delays or complications in the process.

- Ensure all information is truthful and supported by evidence to prevent any issues with your claim.

- Be transparent about the circumstances of the accident to facilitate a fair assessment by Costco Car Insurance.

Effective Communication Tips

- Be clear and concise when explaining the events leading up to the accident.

- Avoid exaggerations or unnecessary details that could confuse the claims adjuster.

- Stay calm and composed when providing information to ensure a professional and efficient interaction.

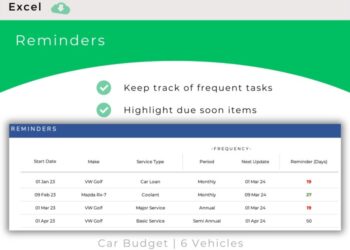

Following Up on the Claim

Once you have filed a claim with Costco car insurance, it is important to have an idea of the typical timeline for processing your claim. Understand that the time it takes to process a claim can vary depending on the complexity of the case and the availability of information.

Timeline for Processing a Claim

Typically, Costco car insurance aims to process claims efficiently within a reasonable timeframe. The processing time can range from a few days to a few weeks, depending on the circumstances surrounding your claim. Keep in mind that the insurance company may need to conduct investigations or gather additional information before reaching a resolution.

Following Up on Delays or Issues

- If you encounter delays or issues with your claim, it is essential to follow up with Costco car insurance promptly. Contact the claims department and inquire about the status of your claim. Be prepared to provide any additional information or documentation they may require to expedite the process.

- Stay proactive and persistent in seeking updates on your claim. Clearly communicate your concerns and ask for a timeline on when you can expect a resolution. Remember to document all communication with the insurance company for future reference.

- If you are experiencing prolonged delays or unresolved issues with your claim, consider escalating the matter to a supervisor or claims manager for further assistance. They may be able to provide more insight into the status of your claim and facilitate a resolution.

Tracking the Progress of Your Claim

To track the progress of your claim with Costco car insurance, you can utilize online portals or customer service channels provided by the company. Log in to your account on the official website or contact the customer service team to inquire about the status of your claim.

Summary

In conclusion, this discussion has covered the essential steps and tips for filing a claim with Costco car insurance hassle-free.

FAQ

What documents are needed to initiate a claim?

You will typically need your policy information, accident details, and any relevant documentation to start the claim process.

How can I track the progress of my claim?

You can usually track your claim's progress through the online portal provided by Costco car insurance or by contacting their customer service.

What should I do if there are delays in processing my claim?

If you experience delays, it's recommended to follow up with Costco car insurance either through phone, email, or their online portal to inquire about the status of your claim.